Today the RBA released the September monthly retail payments data and it is now updated on Qi’s Payments Dashboard.

Find it here: https://payments.qiinsights.com/

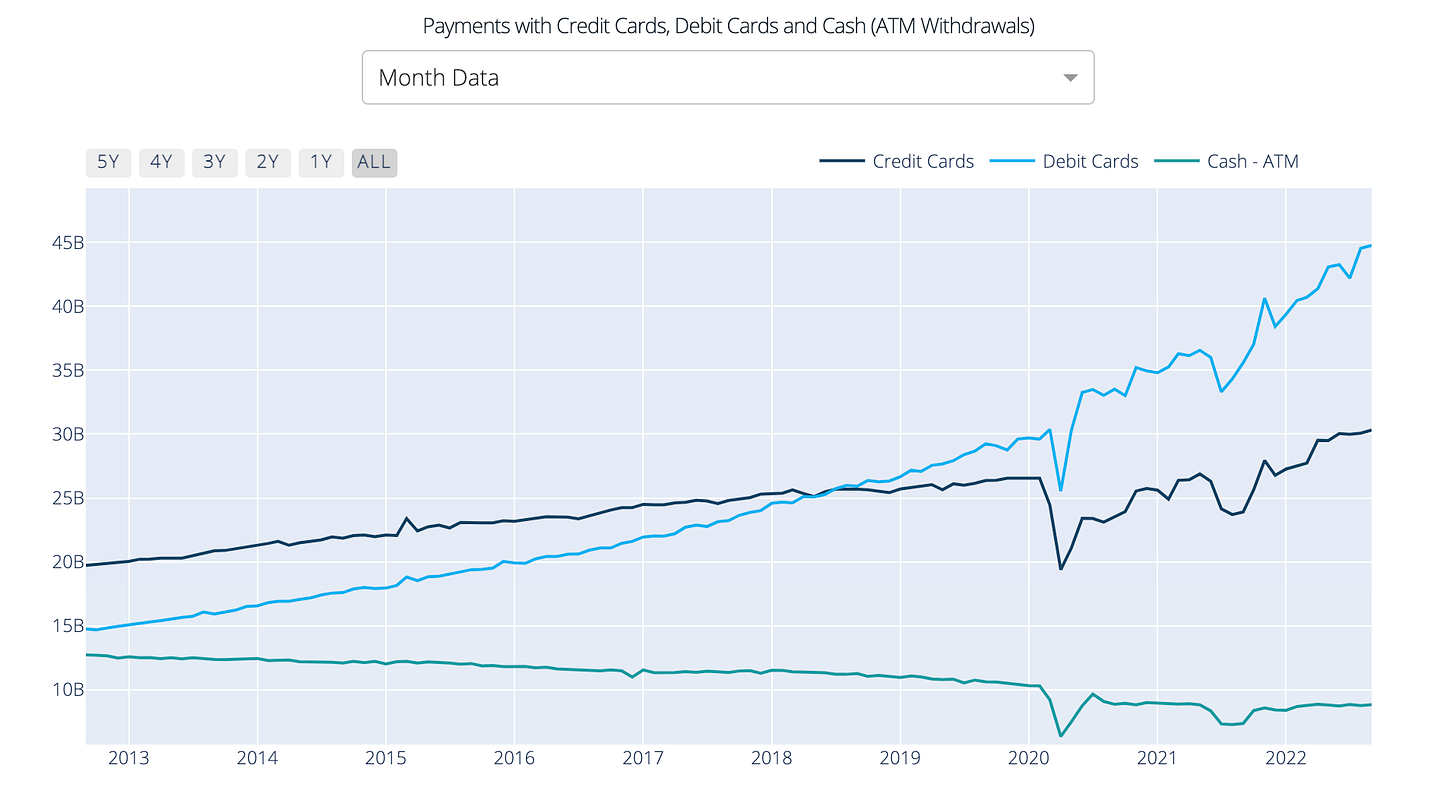

Once again we see record months in both Debit and Credit card purchases, with Credit Cards growing at 15% annually and Debit Cards up 18% annually.

That includes a strong push up in overseas credit card purchases, with people getting back to international travel. As you can imagine, with border closures, overseas purchases lost much of their value - over two thirds - during Covid.

That has not only reversed, but been completely turned around - we are now at record levels for the last 3 months.

Check out the interactive dashboard here and select Overseas from the dropdown. You can also see Personal & Commercial card purchases overseas, as well as Number, Average and Account averages. https://payments.qiinsights.com/apps/explore-creditcard.

September also means an update to Merchant Fees and thus Least Cost Routing savings estimates. With Debit usage through the roof, the potential savings that can be made through LCR continue to rise. That is despite the merchant fees for Eftpos, Visa and Mastercard remaining steady over the last 3 months.

Part of the strength of credit card purchases is the resurgence of Amex/Diners. It is now a $70b market, making up over 21% of credit card usage by value. It also includes an average purchase value 2.5 times that of Visa/Mastercard, and is growing at a faster rate.

Don’t forget Qi’s Payments Dashboard summaries and visualises data from 15 different spreadsheets that the RBA releases each month.

There is a great deal more content on the website, subscribe with a trial to check it out, and let us know if you have any questions.