NAB Buys Citi on Credit

What are the stats behind NAB's purchase of Citibank's Australian business?

Combined, the mortgage book adds just $7b to NAB's $267b mortgage book.

Comparing the books of each bank, there is only one area that significantly changes NAB’s market position.

That area is, of course, credit cards.

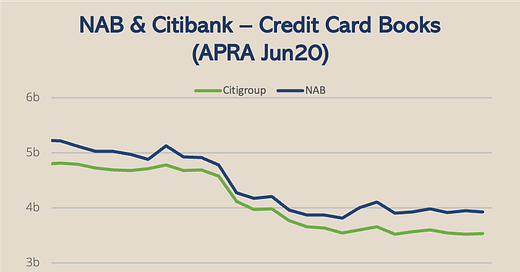

These two banks are ranked 4th and 5th in credit card book size among ADIs.

The combination of NAB & Citibank credit card books doubles its share to 25%.

It also puts NAB ahead of both Westpac and ANZ in market share.

Of course, across the board, credit card loan books are reducing with consumers paying off their balances at higher rates.

But, credit cards use is still increasing, and they remain an important part of the payment landscape.

Loan book sizes taken from APRA’s monthly ADI stats. Explore the data on QI’s dashboard, here: https://app.qiinsights.com/apps/monthly-adi

LinkedIn Post: https://www.linkedin.com/posts/peterdrennan_what-are-the-stats-behind-nabs-purchase-activity-6831066326124105729-Zc9K